Claims

- All Categories

- Driving Laws

- Driving Safety

- Government Claim

- Injury Claim

- Insurance

- Property Damage

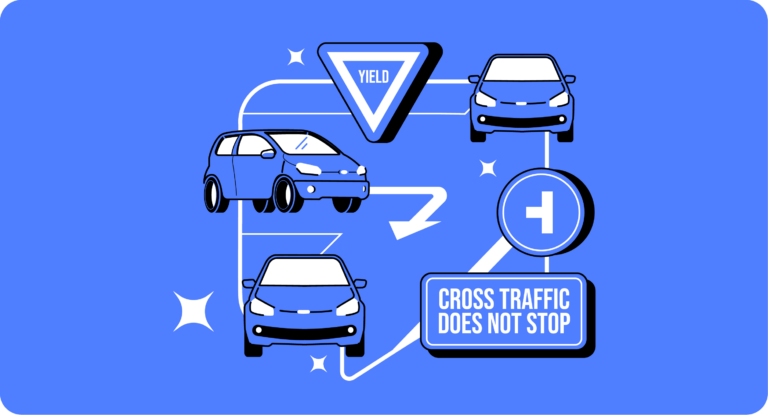

In parking lots, vehicles in driving lanes have the right of way over those in parking spaces. Always yield to oncoming traffic when exiting a spot. If unsure, it’s safest to let cars and pedestrians pass to avoid accidents.

In California, you must report an accident to the police within 10 days if it causes over $1,000 in property damage or any injuries or deaths.

In lawsuits, establishing fault is crucial. “Accident” suggests no deliberate fault, while “crash” might imply someone is responsible.

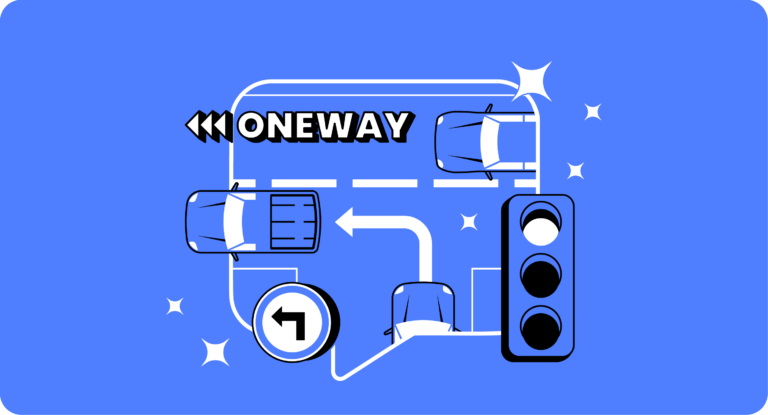

In California, you can only make a left turn on red from a one-way street to another one-way street.

In California, failing to report a car accident involving injuries or significant damage can result in fines or even jail time. It’s legally required to report such accidents to avoid complications and legal issues.

Insurance may cover a rental car for a few days to 30 days after an accident, depending on your policy. If needed, we can help extend your coverage.

Want to Keep Updated on Events and Updates?

Subscribe to our newsletter to receive updates on the content you care about.

We care about your data in our privacy policy.