Discovering your car is missing is a heart-stopping moment. The immediate steps are clear: call the police and your insurance company. But then what? Does car insurance actually cover theft? What happens if your car turns up later? And what if it’s gone for good?

What Are the Key Stages in the Insurance Payout Process?

The insurance payout process for a stolen vehicle typically involves these stages:

Report the Theft to the Police (Immediately!)

Contact your local police department as soon as possible to report the theft. Delays can hinder the investigation and potentially affect your claim. Provide accurate and detailed information, including the date, time, and location of the theft. Describe your vehicle thoroughly, noting any unique features or modifications. Request a police report and keep a copy for your records. This document is crucial evidence for your insurance claim.

File a Claim with Your Insurance Company (Don’t Delay!)

Contact your insurance company immediately after reporting the theft to the police. They will guide you through the claim filing process. Have your policy information and police report readily available. Be prepared to answer questions about the incident, your car’s details, and your coverage options. Ask clarifying questions if unsure about anything.

The Insurance Company Investigation

The insurance company will launch an investigation, which may involve:

- Contacting the police: Verifying the reported theft and gathering details.

- Reviewing your policy coverage: Confirming your comprehensive coverage level and deductible amount.

- Potentially inspecting the scene: Depending on the circumstances of the theft.

Cooperate fully with the investigation, providing any requested information promptly. This helps them reach a decision faster and potentially expedite the payout.

Decision and Payout

Based on the investigation, the insurance company will determine whether your car is:

- Recovered: If found, they will assess the damage and repair costs before determining the payout or potential repair options.

- Declared a total loss: If deemed unrecoverable or repairs exceed the car’s value, they will offer a payout based on its actual cash value (ACV) as outlined in your policy.

- Review the insurance company’s offer carefully. Understand the basis for their decision and the ACV calculation. If you disagree, discuss your concerns and explore potential negotiation options.

Remember, you have the right to seek legal advice if needed, especially in complex cases or if you feel the offer is unfair.

What Timeframe Should I Expect for a Payout?

While there’s no one-size-fits-all answer, the payout timeframe typically falls within 30-45 days after the initial claim filing. Several factors can influence this timeline.

The Complexity of the Investigation

The investigation might require more time and resources if the theft involved suspicious activity, violence, or other extraordinary elements. This could involve interviewing witnesses, forensics, or collaborating with different law enforcement agencies, leading to a longer wait.

If your car was stolen from a unique location, involved multiple vehicles, or requires extensive evidence collection, the investigation might take longer to gather and analyze all the necessary information.

Availability of the Police Report

Delays in filing a police report after the theft can significantly hinder the insurance company’s investigation timeline. The sooner you report, the quicker they can begin their own investigation and move towards a decision.

The insurance company might need to verify the accuracy and completeness of the police report with the authorities, which can add time, especially if there are backlogs or delays in communication.

Vehicle Recovery

If your car is found, the insurance company will need to assess the damage and repair costs before determining the payout amount. This involves arranging inspections, obtaining repair estimates, and potentially negotiating with repair shops, adding another layer to the process and potentially extending the timeline.

If the repairs exceed the car’s actual cash value, the insurance company will declare it a total loss. This usually involves additional paperwork and calculations, potentially impacting the payout timeframe.

Policy Terms and Coverage

Comprehensive coverage is essential for theft claims. If you only have liability coverage, you won’t be reimbursed for the stolen vehicle.

You’ll be responsible for the deductible amount stated in your policy before receiving the payout, regardless of the car’s recovery status. Higher deductibles might lead to longer waits as you gather the funds to cover your portion.

Some policies might have specific timeframes for filing claims or additional requirements that could impact the payout schedule. Carefully review your policy document to avoid any delays due to missed deadlines or unfulfilled requirements.

Remember, communication is key. Stay in touch with your insurance company representative, inquire about the progress of your claim, and promptly address any questions they may have. This helps them move the process forward efficiently and potentially accelerates your payout.

Pro Tip

Filing a police report promptly after your car is stolen is advised. This report serves as crucial documentation for your insurance claim. Remember, the faster you file, the quicker the investigation commences.

What Are the Steps I Can Take to Expedite My Payout?

While you can’t control the insurance company’s internal processes, here are proactive steps to potentially expedite your payout:

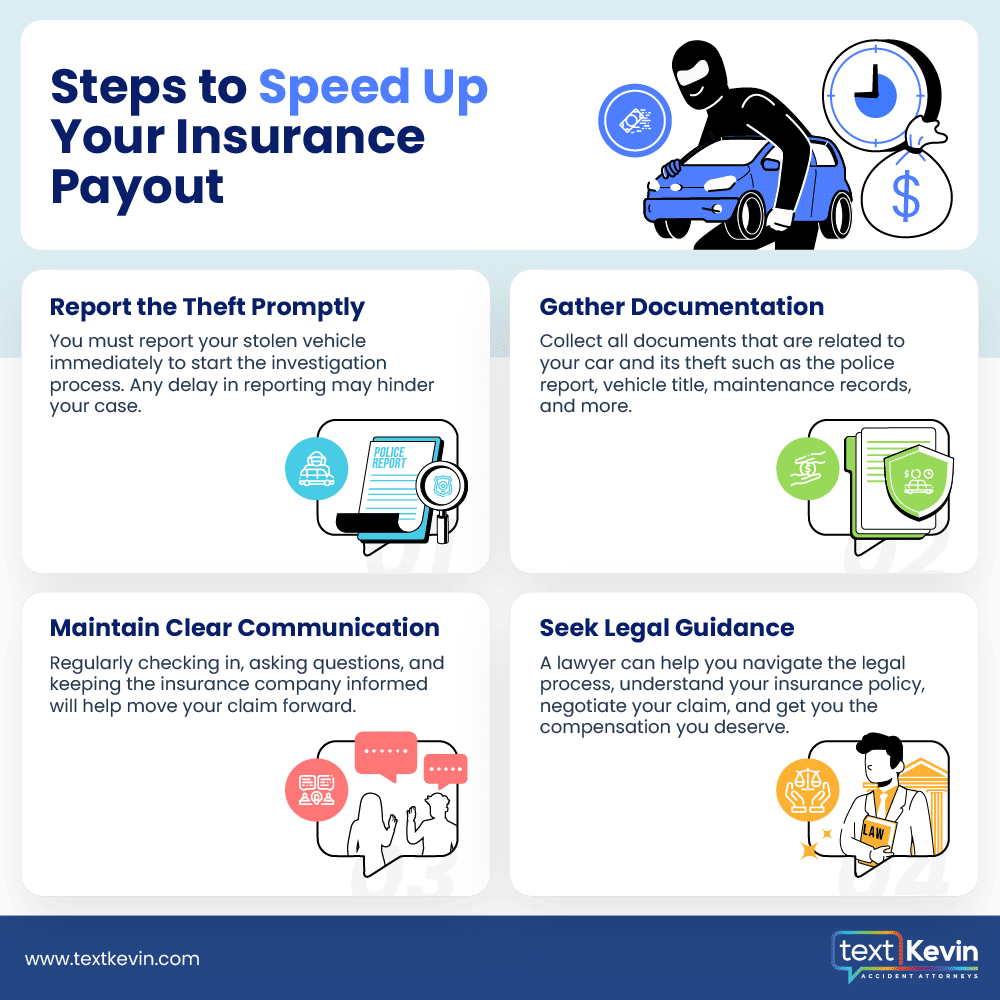

Report the Theft Promptly

Time is of the essence! Contact your local police department immediately to report the theft and file a police report. This sets the investigation wheels in motion and allows your insurance company to begin its process.

Delays in reporting can hinder the investigation, potentially leading to lost evidence or hindering witness recall. The quicker you act, the easier it is to gather information and move towards a resolution.

Gather Documentation

Collect and neatly organize important documents related to your car and the theft. This includes your police report, car title, proof of ownership, maintenance records, and any receipts for recent repairs or modifications.

Having everything readily available demonstrates due diligence and saves time for both you and the insurance company. They can quickly verify essential details and process your claim efficiently.

Maintain Clear Communication

Establish a clear communication line with your insurance company representative. Regularly inquire about the progress of your claim and promptly address any questions they may have.

Don’t wait for them to reach out. Inform them of any relevant updates, like new information from the police or additional documentation you acquire. Keeping them informed shows your engagement and helps keep the claim moving forward.

Seek Legal Guidance

Consulting an experienced car theft lawyer can be beneficial in complex cases. This is especially true if you disagree with the insurance company’s decision or believe something isn’t being handled fairly.

A lawyer can help you understand your insurance policy, negotiate on your behalf, and ensure you receive the compensation you deserve. They can also advise on further legal options if necessary.

Remember, being proactive, organized, and communicative can significantly reduce delays and anxieties associated with a stolen car claim. By taking these steps and understanding your rights as a policyholder, you can resolve this challenging situation with more confidence and achieve a faster resolution.

Tip

Cooperate fully with the insurance company throughout the investigation process. Provide requested information promptly and address their questions comprehensively. This helps them reach a decision faster, potentially accelerating your payout.

What Options Do I Have if the Insurance Company Is Being Unfair?

If you encounter unreasonable delays or feel the insurance company isn’t handling your claim fairly, remember you have options:

Negotiate with the Insurance Company

Compile any documentation that strengthens your case, like repair estimates, proof of car maintenance, or evidence contradicting the insurance company’s assessment. Review your policy meticulously, highlighting specific clauses or coverage details supporting your claim.

Start by contacting your insurance company representative and clearly communicate your concerns and desired outcome, whether it’s a faster payout or a higher settlement amount.

Present your evidence and reasoning calmly and professionally. Be open to discussing their perspective and exploring potential compromises.

If negotiations reach an impasse, consider mediation or seeking legal counsel for further guidance and support.

File a Complaint with the California Department of Insurance (CDI)

- When to consider: If you remain dissatisfied with the insurance company’s response after attempting negotiation, you can file a formal complaint with the CDI.

- The complaint process: The CDI website provides a clear guide on filing and processing complaints. Be prepared to submit detailed information about your claim, communication history with the insurance company, and your desired outcome.

- Potential resolutions: The CDI can investigate your complaint and mediate between you and the insurance company to reach a fair resolution.

- Remember: Filing a complaint doesn’t guarantee a specific outcome, but it can pressure the insurance company to reconsider and potentially move towards a solution you find acceptable.

Seek Legal Counsel

If your case involves complex legal issues, extensive property damage, or a significant disagreement with the insurance company’s assessment, consulting a car theft lawyer is highly recommended. An experienced lawyer can assess your case, advise on the best course of action, represent you in negotiations with the insurance company, or even pursue legal action if necessary.

Legal counsel ensures your rights as a policyholder are protected and that you receive the compensation you deserve under your insurance policy. Lawyer fees might apply, so carefully weigh the potential benefits and costs before making a decision.

Remember, while negotiation and escalation should be considered as last resorts, they are valuable tools available when facing insurance claim disputes. By understanding your options, gathering evidence, and seeking help when needed, you can confidently advocate for your best interests and pursue the fair resolution you deserve in your stolen car claim.

FAQs: Stolen Car Insurance Claims in California

My car was stolen. What should I do first?

Report the theft immediately to your local police department and obtain a police report. Contact your insurance company as soon as possible to file a claim. Be prepared to answer questions about the incident, your car’s details, and your policy coverage.

Does my insurance cover car theft?

Yes, comprehensive coverage on your car insurance policy covers theft. However, you will need to pay your deductible before receiving any payout.

What happens if my car is found after the insurance company pays me?

If your car is found within 30 days of being declared a total loss, the insurance company will typically take possession of the vehicle and sell it at auction. You will receive the sale proceeds minus your deductible and any salvage value the car retains.

How long does it take to get paid for a stolen car?

The average timeframe for a stolen car insurance claim payout falls within 30-45 days, but several factors can influence this, such as the complexity of the investigation, the availability of the police report, and whether your car is recovered.

What if I disagree with the insurance company’s decision or payout offer?

You have several options:

- Negotiate with the insurance company: Gather evidence supporting your claim and attempt to reach a mutually agreeable settlement.

- File a complaint with the California Department of Insurance (CDI): If negotiations fail, you can file a formal complaint with the state’s insurance regulator.

- Seek legal counsel: An experienced car theft lawyer can guide you through your legal options and represent you in pursuing fair compensation.

How often are stolen cars recovered in California?

According to the National Insurance Crime Bureau (NICB), the recovery rate for stolen vehicles in California is around 62%. However, this figure can vary depending on factors like vehicle type, location, and time of theft.

Contact Us to Move Forward with Confidence

Having your car stolen is a stressful experience, but understanding the insurance payout process and available options can empower you to navigate it effectively. By taking proactive steps, staying informed, and seeking legal guidance if needed, you can minimize delays and ensure you receive the compensation you deserve. Contact Text Kevin Accident Attorneys today at [phone] if you have further questions.