If you have a car accident and your car is “totaled,” meaning that the repair cost is more than the car’s value, you might face some challenges. Not only will your routine be disrupted, but you might also owe more money on your car loan than what your car is worth. This is called being “upside down” on your loan. The value of your car on the day of the accident is called the actual cash value (ACV). Gap insurance is a type of coverage that can help you pay the difference between the ACV and the remaining loan balance.

When is a Car Considered a Total Loss?

A car is considered a “total loss” when the insurance company determines that the cost of fixing it is higher than its value. Different states have different rules for calculating this. For example, some states say that a car is totaled if the repair cost is more than 80% of the car’s value.

Suppose you have an accident, and your car’s value is $10,000. The insurance company will check if the repair cost is more or less than $8,000 (80% of $10,000). If it is less, they will pay for the repairs. If it is more, they will declare your car a total loss and pay you the car’s value ($10,000) instead of fixing it. You will have to give them the title of your car. If you still owe money on your car loan, the insurance payment will go to your lender first, and you will get the rest, if any.

Can I Keep My Car Even if it is Totaled?

If your car is totaled, you can keep it or let the insurance company take it. However, keeping a totaled car is not a simple decision. You will have to pay the insurance company the salvage value of your car, which is the amount they can get from selling it for parts. For instance, if your car’s value is $6,000 and the salvage value is $500, you will only receive $5,500 from the insurance company ($6,000 – $500).

Also, you will face other challenges with a totaled car. You will need to get a salvage title showing that your car was damaged and repaired. This can make it hard to sell or insure your car in the future. You will also have to spend a lot of money to fix your car. Therefore, carefully weigh the pros and cons of keeping a totaled car.

Do I Have to Pay Insurance on a Total Loss Car?

When you give up your totaled car to the insurance company, you also stop paying insurance for it. However, if you want to keep and drive your totaled car, you have to follow some rules:

- You have to get your car fixed and inspected.

- You have to get a new title that says your car was rebuilt.

- You have to buy new insurance for your rebuilt car.

Do I Still Have to Pay My Car Loan?

When you have a car loan, you are responsible for paying it off even if your car is totaled. This can be a problem if your car’s value is less than what you owe on your loan. For example, if your car’s value is $10,000 and your loan balance is $12,000, you will have to pay the remaining $2,000 out of your pocket.

Gap insurance is a type of coverage that can protect you from this situation. It pays the difference between your car’s value and your loan balance in case of a total loss. With gap insurance, you won’t have to worry about paying for a car that you can’t drive.

How to Deal with a Car Loan After a Total Loss

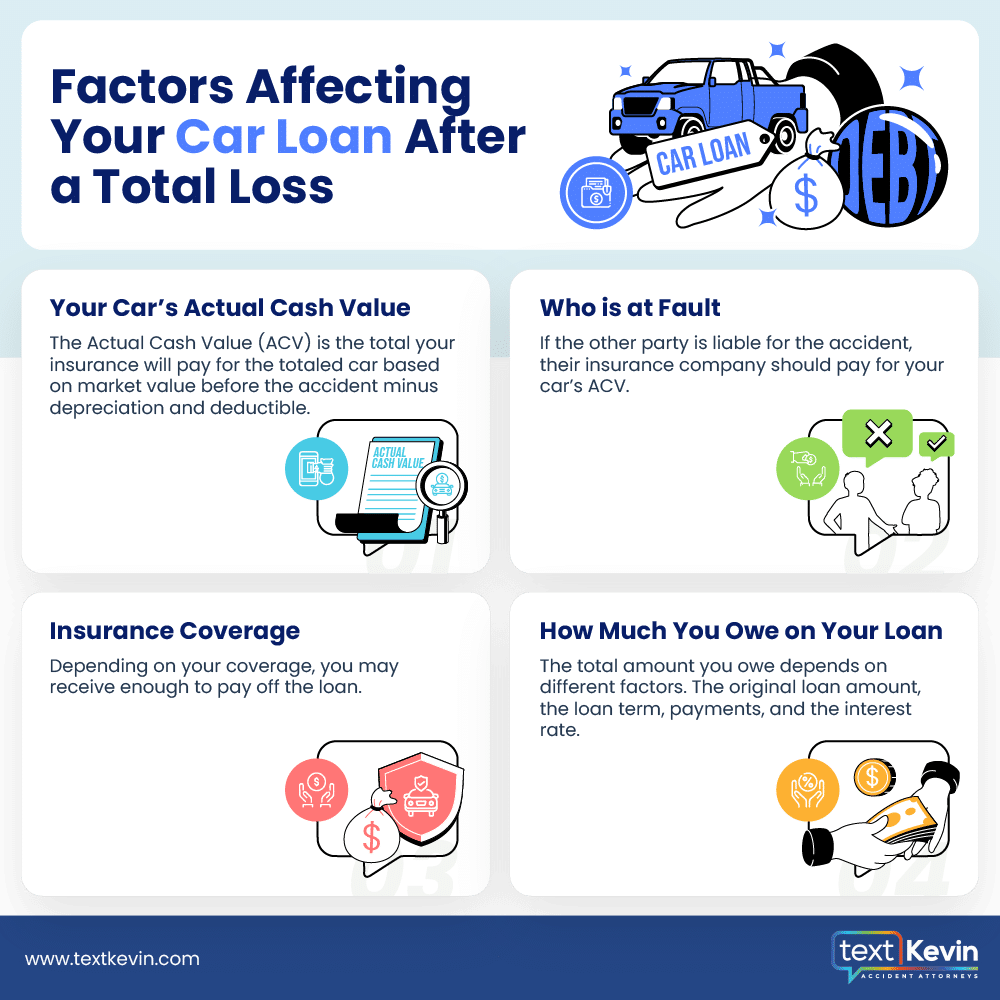

When you buy a car with a loan, you agree to pay back the lender over a certain period of time. But what if your car is totaled in an accident before you pay off the loan? This can be a stressful situation, as you might end up owing more money than your car is worth. To avoid this problem, you need to understand how the following factors affect your car loan after a total loss:

- Your car’s actual cash value (ACV). This is the amount that your insurance company will pay you for your totaled car. It is based on the market value of your car before the accident, minus any depreciation and deductible. Your insurance company will use various sources, such as online databases, local dealerships, and third-party services, to determine your car’s ACV.

- Who’s at fault for the accident. If you are not liable for the accident, the other driver’s insurance company should pay for your car’s ACV. However, if you are at fault or the other driver is uninsured or underinsured, you will have to rely on your own insurance coverage to pay for your car’s ACV. This means that you need to have collision or comprehensive coverage on your policy, depending on the cause of the accident. If you only have liability coverage, you will not receive any payment from your insurance company for your totaled car.

- Insurance coverage. Depending on the type and amount of insurance coverage you have, you might receive enough money to pay off your car loan or not. For example, if your car’s ACV is $10,000 and your loan balance is $8,000, you will have enough money to pay off your loan and have some left over. But if your car’s ACV is $8,000 and your loan balance is $10,000, you will have a gap of $2,000 that you will have to pay out of pocket. This is called being upside down or underwater on your loan. To avoid this situation, you can purchase gap insurance, which is a type of coverage that pays the difference between your car’s ACV and your loan balance in case of a total loss.

- How much you owe on your loan. The amount of money you owe on your car loan depends on several factors, such as the original loan amount, the interest rate, the loan term, and the monthly payments. The faster you pay off your loan, the less likely you are to be upside down on it. However, if you have a long-term loan, a high interest rate, or a low down payment, you might owe more money than your car is worth for a longer period of time. This increases the risk of being upside down on your loan if your car is totaled.

How Insurance Affects Your Car Loan After a Total Loss

When you borrow money to buy a car, your lender will require you to have car insurance. This is to protect both you and the lender in case something happens to your car. However, car insurance may not be enough to pay off your loan if your car is totaled in an accident or by another cause.

Your car insurance will pay you the actual cash value of your car if it is a total loss. The ACV is the market value of your car before the damage, minus any depreciation and deductible. Your insurance company will use various sources, such as online databases, local dealerships, and third-party services, to determine your car’s ACV.

However, the ACV may not match the amount you owe on your loan. This can happen if your car depreciates faster than you pay off your loan or if you have a long-term loan, a high interest rate, or a low down payment. If you owe more on your loan than the ACV, you will have a gap that you will have to pay out of pocket. This is called being upside down or underwater on your loan.

To avoid this situation, you can buy gap insurance, which is a type of coverage that pays the difference between your car’s ACV and your loan balance in case of a total loss. Gap insurance can be purchased from your lender, your insurance company, or a third-party provider. Gap insurance can save you from paying for a car that you can’t drive.

What Happens When You Total a Financed Car Without Insurance?

Most states require drivers and car owners to have some form of liability insurance or proof of financial responsibility to drive or register a car. Liability coverage pays for other people’s injuries and property damage when you are legally responsible (liable) for an accident.

Collision coverage is optional coverage that pays for damage to your car—minus your deductible—no matter who is at fault for the accident. If you total your car in an accident that you caused without collision coverage, you have to pay out of pocket to replace your totaled car.

Even if you are not at fault for the accident, your compensation might be limited if you don’t have insurance. Several states have “No Pay, No Play” laws. In these states, if you don’t have car insurance at the time of an accident, your ability to recover damages is restricted or barred entirely.

How to Handle Your Car Loan When the Other Driver Is Uninsured

If you total your car in an accident caused by another driver, you might expect that driver’s insurance will pay for your car’s value and your loan balance. However, not all drivers have insurance, and some have insufficient coverage. In that case, you will have to use your own insurance or other options to deal with your car loan.

One option is to buy underinsured or uninsured motorist coverage (UMI), which is a type of insurance that pays for your damages when the other driver has no or low insurance. UMI can help you pay off your loan and get a new car. Make sure your UMI policy includes property damage, not just bodily injury.

Another option is to file a claim under your collision coverage, which is a type of insurance that pays for your car’s damage regardless of who is at fault. Collision coverage can also help you pay off your loan and get a new car. However, you will have to pay a deductible, which is the amount you pay before your insurance kicks in.

A third option is to sue the other driver for your damages, but this might not be very effective. The other driver might not have any assets or income that you can collect from. You will also have to pay for legal fees and wait for a long time to get a judgment. This option is only advisable if you have strong evidence that the other driver has the ability to pay.

What Is Gap Insurance? How Does It Work? When Do I Need It?

Gap insurance is a type of car insurance that pays the difference between what your car is worth and what you owe on your car loan if your car is totaled or stolen. You can buy gap insurance from your lender or your insurance company.

Gap insurance is useful if you have a car loan that is higher than your car’s value. This can happen if you have a long loan term, a low down payment, or extra fees and charges added to your loan. Some cars also lose value faster than others. You can use online tools like Kelley Blue Book to check your car’s value and compare it with your loan balance.

Before you buy gap insurance, make sure you don’t already have it in your car insurance policy. Some policies include gap insurance as part of their coverage.

Tip

Gap insurance can significantly relieve financial stress after a total loss. Consider the cost-benefit of adding it to your policy if not already included.

What Does Gap Insurance Not Cover?

Gap insurance does not cover everything. It only applies when your car is totaled or stolen, and you owe more on your loan than your car’s value.

Gap insurance does not cover:

- Car repairs

- Replacement parts

- A new car

- A rental car after an accident

- Medical bills

- Lost wages, and

- Damage to other people’s property.

For these expenses, you will need other types of car insurance, such as collision, comprehensive, medical payments, rental reimbursement, and liability. Gap insurance is not a substitute for these coverages but a supplement to them.

How to Dispute a Low Settlement Offer for Your Totaled Car

If your car is totaled and you don’t have gap insurance, you might end up owing more money on your loan than what the insurance company pays you. However, you don’t have to accept the first offer they make. You can challenge their valuation of your car and try to get a higher settlement.

To do this, you need to do your own research and find out how much your car was worth before the accident. You can use online tools like Kelley Blue Book or Edmunds to get an estimate or look for similar cars for sale in your area. You should also gather any documents or photos that show your car’s condition and features. Then, you can present your evidence to the insurance adjuster and ask for a higher amount.

If the insurance company still refuses to budge, you might need legal help. You can consult with a car accident lawyer who handles car accident claims. They can advise you on your options, such as filing a bad faith claim, requesting arbitration, or suing the insurance company. A lawyer can also represent you in court and negotiate on your behalf.

Pro Tip

Review your policy documents thoroughly, focusing on coverage amounts, deductibles, and exclusions. Contact your insurance agent if you are unsure about any details.

Buying a New Car After Your Car Is Totaled

When your car is totaled, you might need to buy a new car to replace it. The amount of money you get from your insurance company for your totaled car can affect your ability to buy a new car.

If you have paid off your car loan, you can use the whole insurance payout to buy a new car. If you still have a car loan, and your car’s value is higher than your loan balance, you can use the insurance payout to pay off your loan and have some money left to buy a new car. If you owe more on your loan than your car’s value, you will have to pay the difference yourself. You can use your savings or ask your lender to roll over your debt into a new car loan.

RELATED ARTICLES:

- What Happens to the License Plates When Your Car is Totaled?

- Who Gets the Insurance Check When a Car is Totaled?

Contact a Car Accident Lawyer

At Text Kevin Accident Attorneys, we can help you determine your car’s actual cash value and work for a fair settlement.

Carefully consider your financial situation and transportation needs before purchasing a new car. Research replacement options, compare prices, and negotiate financing terms to stay within your budget. Remember, don’t rush into decisions that could further burden you.

Contact Text Kevin Accident Attorneys today for a free consultation, and let us help you protect your rights. Call (888) 965-3827.