- Property Damage

When your car is totaled in an accident, the recipient of the insurance check depends on the ownership and financial status of the vehicle at the time of loss. If you own the car outright, the insurance settlement is paid directly to you. However, if the car is financed and there’s still a loan balance, the insurance company sends the settlement amount directly to the lender to cover the remaining loan balance. Should there be any surplus after paying off the loan, this amount is then sent to you.

What Does It Mean When a Car is Totaled?

A car is considered “totaled” when the cost of repairing the damage from an accident exceeds the car’s value or a certain percentage of its value. This percentage is not fixed but depends on the criteria of the insurance company that covers the car. The insurance company may also follow the state regulations or its own policies to determine this percentage.

The car’s value is measured by its actual cash value (ACV), which is the amount the car would sell for in the market at the time of the accident, taking into account factors such as age, mileage, and condition. The insurance company will compare the repair cost and the ACV to decide if the car is a total loss or not. If the car is a total loss, the insurance company will not pay for the repairs but will instead pay the car owner the car’s ACV minus any deductible that applies. This way, the insurance company can avoid spending more money than the car is worth.

The process of determining if a car is totaled involves a careful analysis of the costs and benefits from the insurance company’s point of view, as well as a consideration of the legal and contractual obligations. The process also reveals the dynamic and complex relationship between the repair industry, the insurance industry, and the car market, which all play a role in shaping the outcome of totaled car claims.

How Do Insurance Companies Determine Compensation in Total Loss Scenarios?

When a car is involved in an accident, the insurance company that covers the car has to decide how to compensate the car owner for the damage. The compensation amount depends on whether the car is considered a total loss or not. A total loss means that the cost of repairing the car is higher than the car’s value or a certain percentage of its value. This percentage varies by state and by insurance company, but it usually ranges from 50% to 80%.

If the car is a total loss, the insurance company will pay the car owner the ACV of the car, which is the amount the car would sell for in the market at the time of the accident. The ACV is calculated based on factors such as the car’s age, mileage, condition, and depreciation. The insurance company will also deduct any applicable deductible from the ACV.

If the car is not a total loss, the insurance company will pay for the necessary repairs up to the limit of the car’s value or the policy’s coverage. The car owner may also have to pay a deductible, depending on the terms of the policy.

The insurance company’s goal is to resolve the claim in the most cost-effective way while also fulfilling its legal and contractual obligations. The insurance company will use various sources of information, such as repair estimates, market data, and state regulations, to determine the car’s value and the repair cost. The insurance company may also negotiate with the car owner or a third party, such as a salvage yard or a lienholder, to reach a fair settlement.

Who Receives the Insurance Check?

For vehicles owned outright, the insurance company issues the payout directly to the owner. However, when a vehicle is financed, and there’s an outstanding loan, the insurer’s primary obligation is to settle the loan balance with the lender or finance company. Should the insurance payout exceed the loan balance, the remaining funds are disbursed to the vehicle owner. This system ensures that financial obligations are prioritized while also compensating the owner for their loss, contingent on the specifics of their policy and the assessed value of the vehicle at the time of the incident.

Impact of Loan or Lease on Insurance Settlements

When a vehicle is financed or leased, the insurance settlement process after it’s deemed a total loss involves a few additional steps compared to a vehicle owned outright. The primary concern is to settle any outstanding loan or lease balance with the financial institution or leasing company. The insurance payout, based on the vehicle’s ACV, is typically directed to the lienholder or lessor first. If the insurance compensation exceeds the amount owed, the surplus is paid to the policyholder.

However, if the settlement doesn’t cover the full balance, the vehicle owner may be responsible for the difference unless they have gap insurance, which covers this shortfall.

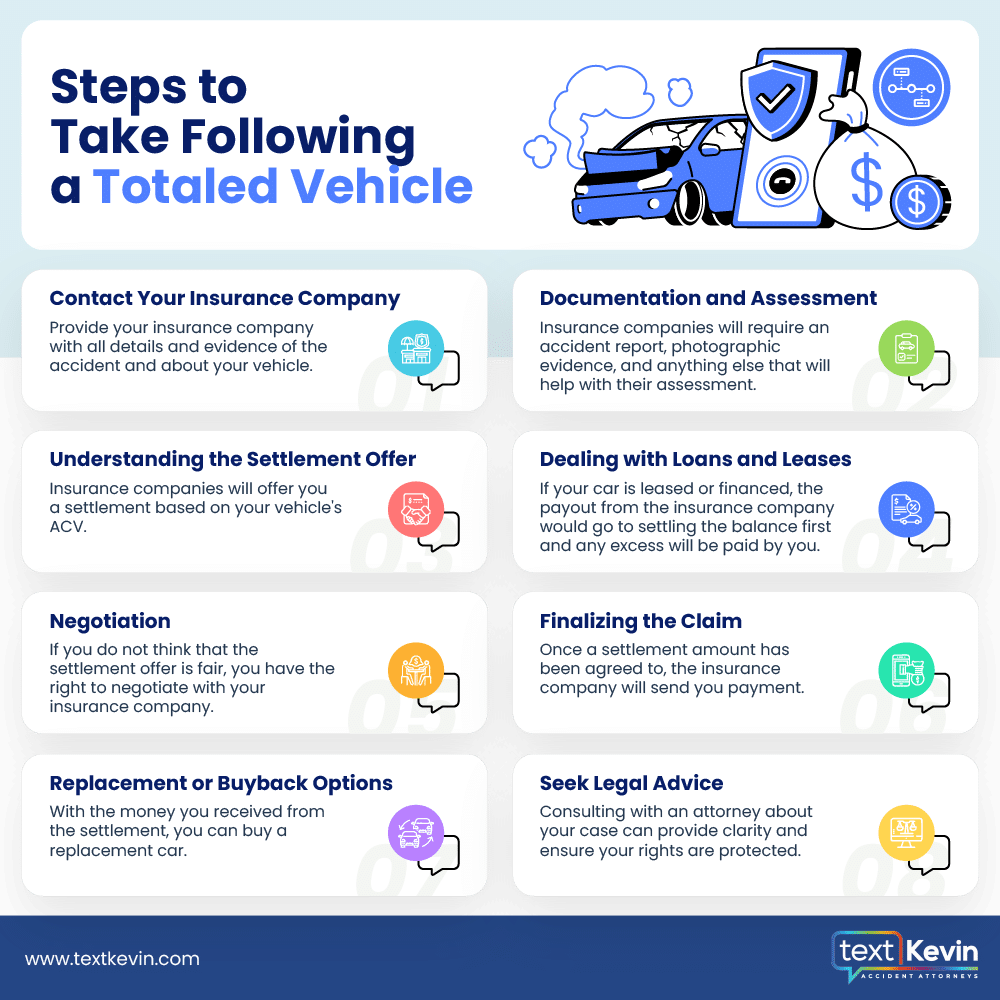

What Are the Steps to Take After My Vehicle Is Totaled?

When you find out your vehicle has been totaled, it can be an overwhelming experience. However, having a clear action plan can significantly ease the process. Here are the steps to guide you through managing insurance claims and moving forward after your vehicle is deemed a total loss:

- Contact Your Insurance Company: The first step is to get in touch with your insurance provider to initiate a claim. Provide them with all the necessary details about the accident and your vehicle. Have your policy number, the date and time of the accident, a police report (if available), and photographs of the vehicle’s damage on hand.

- Documentation and Assessment: Your insurance company will require documentation to assess the claim. This includes the accident report, photographs of the damage, and any other relevant information that can help determine the extent of the damages. An insurance adjuster will be assigned to your case to evaluate the vehicle’s condition and determine whether it’s a total loss.

- Understanding the Settlement Offer: Once the insurance adjuster concludes that repairing your vehicle is not economically feasible, they will calculate its ACV. The ACV represents the market value of your vehicle just before the accident. Your settlement offer will be based on this value minus any deductible that applies to your policy.

- Dealing with Loans or Leases: If your vehicle was financed or leased, the insurance payout would first go toward settling any outstanding balance with the lender or leasing company. If the settlement amount exceeds what you owe, the excess will be paid to you. If it’s less, you might need gap insurance to cover the difference.

- Negotiation: If you believe the settlement offer does not accurately reflect your vehicle’s value, you have the right to negotiate with your insurance company. Provide evidence such as maintenance records, upgrades, and comparisons of similar vehicle prices in your area to support your case.

- Finalizing the Claim: Once you agree on a settlement amount, the insurance company will process the payment. Ensure you understand any paperwork you’re signing, as it may include the transfer of your vehicle’s title to the insurance company.

- Replacement or Buyback Options: With the settlement funds, you can look for a replacement vehicle. Alternatively, some insurers allow owners to buy back the totaled vehicle at its salvage value. If you choose this route, be aware of the legal and safety implications of repairing and re-registering a salvage vehicle.

- Seek Legal Advice: If at any point you feel overwhelmed or uncertain about the process, consulting with a legal representative with experience in auto insurance claims can provide clarity and ensure your rights are protected.

By following these steps, you can manage the situation more effectively and make informed decisions about your next steps.

Common Challenges and How to Overcome Them

To handle disputes with insurance companies over totaled vehicle claims, start by thoroughly reviewing your insurance policy to understand your coverage details. Gather all necessary documentation, including repair estimates, valuation reports, and any evidence that supports your claim’s value. Communication is key, so maintain a detailed record of all correspondence with the insurance company. If negotiations stall, consider consulting with a lawyer to explore your options for mediation, arbitration, or legal action. This approach can help ensure that you receive a fair settlement for your totaled vehicle.

FAQs: Addressing Your Concerns

Let’s address some common questions and concerns that arise in total loss situations with vehicles:

What if the insurance payout is less than what I owe on my vehicle?

If the insurance payout doesn’t cover what you owe on your loan or lease, you’re responsible for the difference unless you have gap insurance. Gap insurance covers the difference between the insurance payout and the amount you owe.

Can I negotiate the total loss value with my insurance company?

Yes, you can negotiate the total loss value. Compile evidence such as recent vehicle upgrades, maintenance records, and comparisons of similar vehicles in your market to support your case for a higher valuation. If you are having difficulty with this stage of the process, you should reach out to a lawyer for advice and representation.

What happens to my vehicle after it’s declared a total loss?

Typically, the insurance company takes possession of the totaled vehicle once the claim is settled. You’ll sign over the title to the insurer. In some cases, you may have the option to buy back the salvaged vehicle at its residual value.

How long does the total loss process take?

The timeframe can vary depending on the complexity of the claim, the thoroughness of the documentation, and the responsiveness of all parties involved. Generally, it may take a few weeks to several months to complete the process.

What should I do if I disagree with the insurance company’s decision?

If you disagree with the total loss determination or settlement amount, you can dispute the decision. Start by discussing your concerns with your insurance adjuster. If unresolved, you may need to seek mediation, file a complaint with your state’s insurance department, or consult with an attorney who handles insurance disputes.

These questions and answers should provide a foundational understanding of how total loss situations are handled and what steps you can take to navigate the process effectively.

FURTHER READING

- What to Do When Your Car is Totaled and You Still Owe Money

- What Happens to the License Plates When Your Car is Totaled?

Contact an Experienced Car Accident Attorney Today

If you’re facing the challenge of dealing with a totaled car, consulting with an experienced attorney like Kevin Crockett can provide you with the guidance needed to handle the insurance settlement process successfully. Call us today at (800) 900-9393 or visit one of our many offices across the state of California if you’re in need of personalized legal assistance to resolve your car accident insurance claim.

Kevin Crockett

Kevin Crockett is an award-winning personal injury lawyer who understands the impact an accident can have on someone’s life. That’s why he aggressively fights for each of his clients.