- Insurance

While being hit by an uninsured driver or being a hit-and-run victim presents challenges, it doesn’t automatically mean you’re out of options. With the right knowledge and potentially the help of a skilled attorney, you can still pursue compensation for your injuries and damages.

What Are California’s Insurance Requirements?

California requires all drivers to carry minimum liability insurance coverage. This minimum coverage includes:

- Bodily injury liability: $15,000 per person/$30,000 per accident covering injuries to others you cause.

- Property damage liability: $5,000 per accident covering damage to others’ property you cause.

However, not everyone follows the law, leaving innocent victims in “uninsured motorist” situations. A significant number of drivers in California operate without insurance, creating a substantial risk for others on the road.

When an uninsured driver causes an accident, victims face the challenge of recovering compensation for:

- Medical expenses for injuries

- Vehicle repairs or replacement

- Lost wages due to missed work

- Pain and suffering

The limited financial resources of uninsured drivers often make recovering compensation directly from them difficult, leaving victims feeling frustrated and burdened.

Uninsured Motorist (UM) Coverage in California

California’s high rate of uninsured drivers makes Uninsured Motorist (UM) coverage a crucial consideration for all car owners. UM coverage protects you financially if you’re injured in an accident caused by a driver who:

- Lacks any liability insurance whatsoever (uninsured motorist)

- Carries insurance, but with limits insufficient to cover your damages (underinsured motorist)

It covers medical expenses, lost wages, pain and suffering, and other accident-related losses.

While UM coverage is optional, California law requires insurance companies to offer it to all policyholders. They must also inform them of its benefits and limitations at the time of purchase.

You can reject UM coverage, but you must do so in writing. Insurance companies are obligated to explain the potential consequences of rejecting this coverage clearly.

If you choose UM coverage, California law mandates minimum limits that match your liability coverage limits. For example, if your bodily injury liability coverage is $15,000/$30,000, your UM coverage must also be at least $15,000/$30,000.

Key Points to Remember

- Consider purchasing UM coverage even if you exceed the minimum limits. Higher limits offer greater protection in case of severe accidents.

- File a UM claim promptly if involved in an accident with an uninsured or underinsured motorist. Cooperate with your insurer throughout the claims process.

- An experienced car accident lawyer can guide you through UM claims and ensure you receive fair compensation.

How Do I Pursue a Lawsuit Against an Uninsured Driver in California?

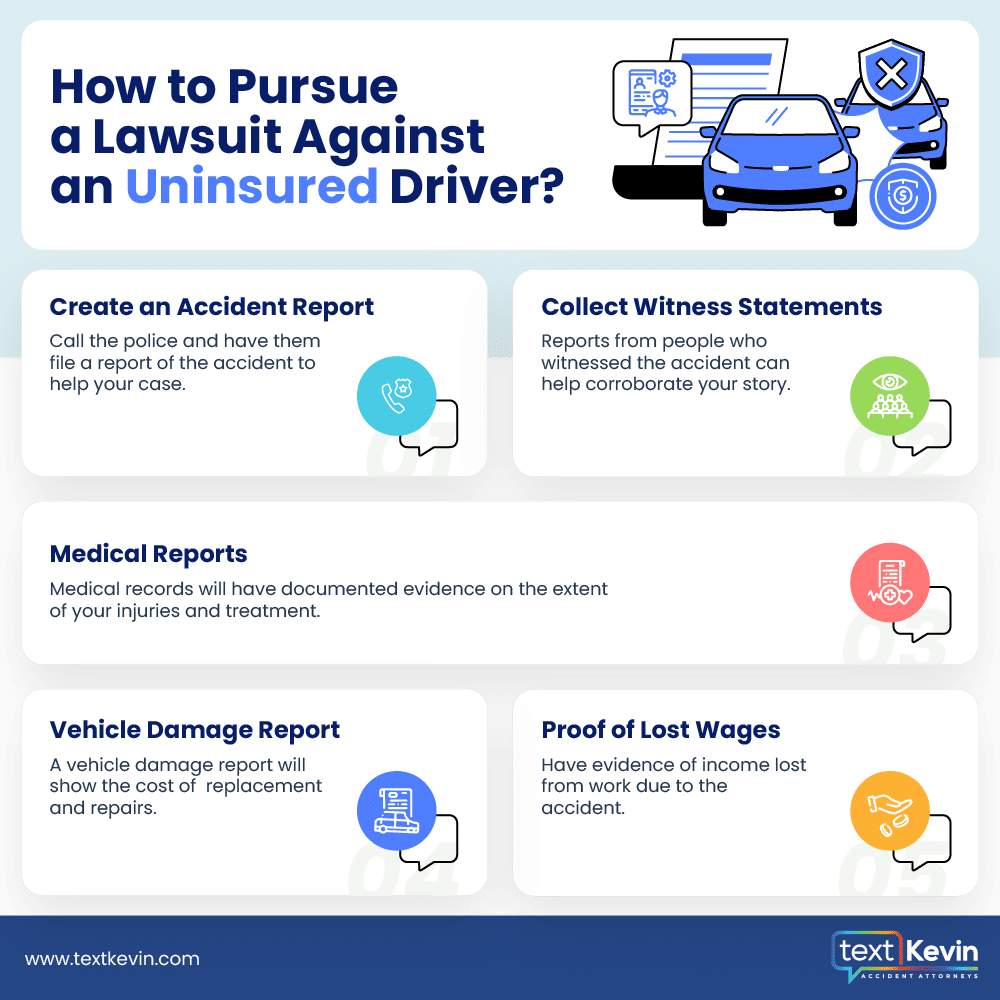

The core of your lawsuit hinges on proving the uninsured driver’s negligence directly caused your accident and ensuing damages. This involves gathering evidence like:

- Accident report: Obtained from law enforcement upon filing a report after the accident.

- Witness statements: Corroborating your version of events and the at-fault driver’s actions.

- Medical records: Documenting the nature and extent of your injuries.

- Vehicle damage reports: Demonstrating the cost of repairs or replacement.

- Proof of lost wages: Verifying income loss due to the accident.

California adheres to a “pure comparative negligence” system. This means any negligence you might have contributed to the accident will proportionally reduce your recoverable damages. For example, if you’re found 20% at fault, you can only recover 80% of your damages from the uninsured driver.

When filing and pursuing a personal injury lawsuit, especially against an uninsured driver, a lawyer can help gather evidence and represent you in court if necessary. But even if you win your lawsuit, collecting compensation from an individual with limited financial resources can be challenging. Your lawyer can explore options like wage garnishments or liens on property, but success is not guaranteed.

While pursuing a lawsuit against an uninsured driver in California presents challenges, it might be your only option if you lack UM coverage and suffered significant damages. Consulting with a car accident lawyer and exploring all avenues for compensation is advised in such situations.

What Steps Should I Take After an Uninsured Driver Accident?

Following an accident with an uninsured driver, the actions you take and the evidence you collect play a large role in strengthening your case and potentially recovering compensation. Here are key considerations to remember:

Prioritize Your Health

- Seek Medical Attention: Regardless of how you feel, promptly seek medical attention. Even seemingly minor injuries can worsen over time, and documented medical records become powerful evidence of accident-related harm.

- Follow Doctor’s Orders: Meticulously adhere to your doctor’s prescribed treatment plan and attend all follow-up appointments. This demonstrates the severity and ongoing impact of your injuries.

Document the Scene

- Gather Details: Note down the date, time, and location of the accident. If possible, exchange contact information with any witnesses and obtain their written statements about what they saw.

- Capture Evidence: Take detailed photos of the accident scene, including vehicle damage, skid marks, and any surrounding hazards. These visuals can reconstruct the events and highlight potential contributing factors.

Connect with a Lawyer

- Legal Representatoin: Consulting with a car accident lawyer familiar with California law is advised. They can guide you through the the legal process, advise on your options, and help you build a strong case against the uninsured driver.

- Preserving Rights: An experienced lawyer understands the importance of deadlines and evidence preservation. They can ensure you meet all legal requirements and prevent any missteps that could jeopardize your claim.

Additional Key Actions

- File an Accident Report: Promptly file a police report after the accident, even if the uninsured driver flees the scene. This official documentation serves as a crucial record of the incident.

- Contact Your Insurance Company: Inform your insurance provider about the accident, even if you don’t have UM coverage. They can offer guidance and support within the scope of your existing policy.

- Keep Detailed Records: Maintain meticulous records of all expenses related to the accident, including medical bills, vehicle repair estimates, and lost wages. These records substantiate your financial losses and strengthen your claim for compensation.

Remember, while the journey towards recovering compensation from an uninsured driver can be challenging, taking these initial steps demonstrates your proactive approach and bolsters your case significantly. An experienced car accident lawyer can be your invaluable ally in navigating this process and advocating for your rights.

Don’t Miss Your Window: California’s Statute of Limitations for Uninsured Driver Lawsuits

In California, the clock starts ticking the moment you sustain injuries in an accident caused by an uninsured driver. Missing the deadline to file a lawsuit, known as the “statute of limitations,” can severely hinder your ability to recover compensation for your losses.

The Two-Year Rule

- California adheres to a two-year statute of limitations for filing personal injury lawsuits. This means you generally have two years from the date of your accident to initiate legal action against the responsible party, including uninsured drivers.

- Exceptions Exist: While the two-year rule is the standard, certain exceptions might apply in specific situations. For instance, if you were a minor at the time of the accident, the statute of limitations might be tolled (paused) until you reach adulthood. Consulting with a lawyer is crucial to determine if any exceptions apply to your case.

Consequences of Missing the Deadline

Missing the deadline to file your lawsuit carries significant consequences. If you wait beyond the two years, you lose the legal right to sue the at-fault driver, regardless of how strong your case might be. This effectively bars you from pursuing any form of compensation through the court system.

Given the potential ramifications of missing the deadline, it’s best to act quickly after your accident. Contacting a car accident lawyer familiar with California law as soon as possible allows them to assess your case, gather evidence, and initiate legal proceedings before the time window closes.

Additional Considerations

- Discovery Rule: California operates under the “discovery rule.” This means the two-year clock might not start automatically on the accident date. Instead, it might begin when you discover the injury and its connection to the accident. This can be complicated, especially for delayed injuries or latent health issues. Consulting with a lawyer helps ensure you understand the specific application of the discovery rule in your case.

- Tolling: As mentioned earlier, certain circumstances might “toll” the statute of limitations, essentially pausing the countdown. Examples include being a minor at the time of the accident or actively engaged in settlement negotiations with the at-fault driver’s insurance company. Again, legal counsel can clarify if any tolling provisions apply to your situation.

Remember, time is of the essence when dealing with uninsured driver accidents in California. Understanding the two-year statute of limitations and seeking legal guidance promptly are crucial steps towards protecting your right to compensation.

Uninsured Motorist Accident FAQs: Protecting Yourself in California

What happens if I’m in an accident caused by an uninsured driver?

This can be a challenging situation, but you have options. Remember, California requires all drivers to have minimum liability insurance, but unfortunately, not everyone follows the law. If you’re hit by an uninsured driver, you can:

- File a claim with your own Uninsured Motorist (UM) coverage: If you have UM coverage on your policy, file a claim immediately. This coverage protects you in case of accidents with uninsured or underinsured drivers.

- Pursue a personal injury lawsuit against the at-fault driver: This route requires legal representation and involves proving their negligence caused your accident and damages.

- Explore alternative avenues: Depending on the specific circumstances, you might be eligible for compensation from the California Uninsured Motorist Fund (UMF).

Do I have to have Uninsured Motorist (UM) coverage?

No, UM coverage is optional in California. However, considering the high rate of uninsured drivers in the state, it’s highly recommended to protect yourself financially in case of such an accident.

What should I do immediately after an accident with an uninsured driver?

- Seek medical attention: Even if you feel okay, prioritize your health. Get checked by a doctor and document any injuries.

- Secure evidence: Gather details like the date, time, location, and photos of the scene, damage, and any witnesses.

- File a police report: Report the accident to the authorities, even if the driver flees.

- Contact your insurance company: Inform them of the accident, even if you don’t have UM coverage.

- Consult a car accident lawyer: An experienced lawyer can guide you through your options, navigate legal complexities, and help you maximize your chances of compensation.

What is the time limit for filing a lawsuit against an uninsured driver in California?

California has a two-year statute of limitations for personal injury lawsuits. This means you generally have two years from the accident date to initiate legal action. Missing this deadline can significantly hinder your ability to recover compensation.

What if I can’t afford a lawyer?

Many car accident lawyers work on a contingency fee basis, meaning they only get paid if they win your case. This allows you to seek legal representation without upfront costs.

Contact a California Car Accident Lawyer

While encountering an uninsured driver after an accident presents challenges, remember you’re not alone. By understanding your options, gathering evidence, and seeking legal guidance promptly, you can increase your chances of recovering compensation and navigating this difficult situation effectively.

Contact us today at (800) 900-9393 for a free consultation, and let us help you get the justice you deserve.

Kevin Crockett

Kevin Crockett is an award-winning personal injury lawyer who understands the impact an accident can have on someone’s life. That’s why he aggressively fights for each of his clients.