Being involved in a car accident without insurance, yet not at fault, places you in a unique legal situation. Even without insurance, the fault is a critical factor, and you might be able to claim compensation for damages caused by the at-fault driver. This includes medical expenses, vehicle repairs, lost earnings, and even pain and suffering. However, the lack of mandatory auto insurance may lead to penalties despite your entitlement to seek damages from the responsible driver’s insurance for the accident. This guide, authored by Kevin Crockett of the Crockett Law Group, goes into what you should know and do in these circumstances.

What Are the Immediate Steps to Take Following the Accident?

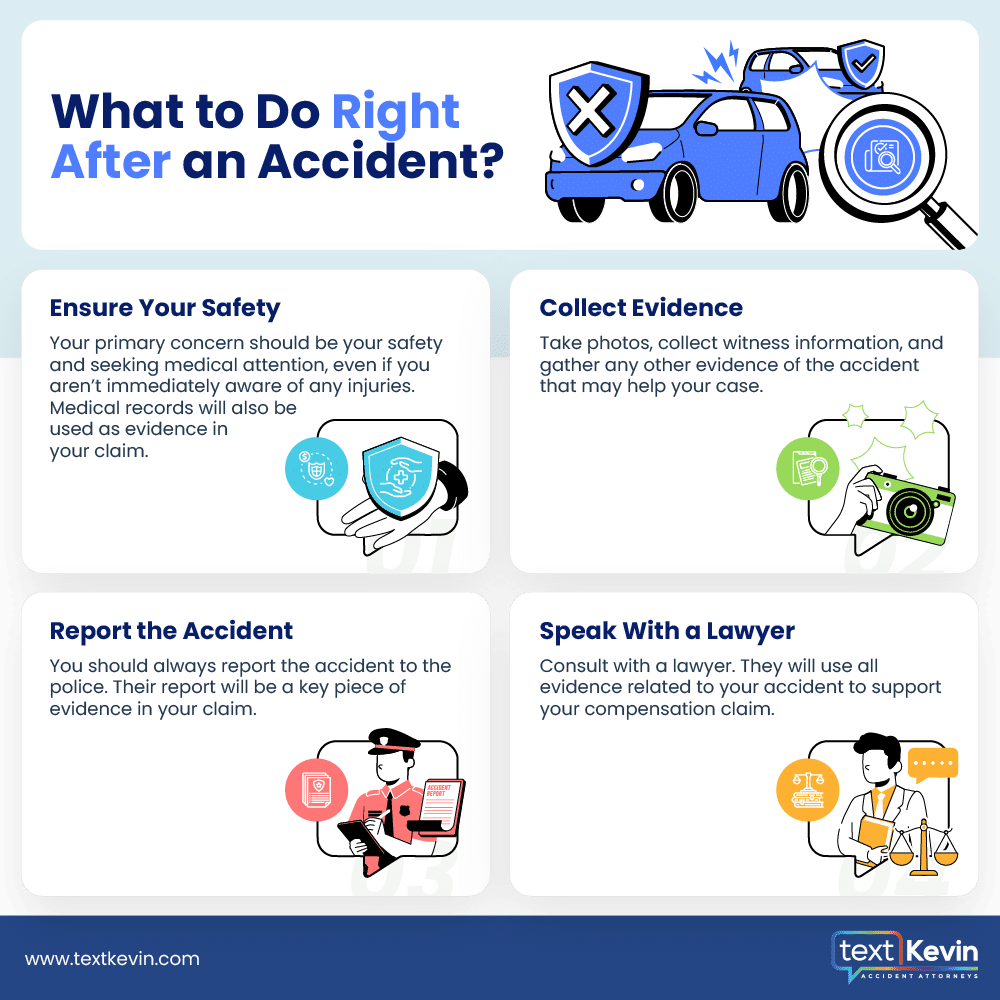

After an accident, your immediate focus should be on ensuring your safety and seeking medical attention, even if you don’t notice any injuries initially. Medical records will serve as evidence for your claim.

Following medical treatment, document the accident scene comprehensively, capture photos, and gather witness information.

Reporting the incident to law enforcement is another step to take, as the police report is a key piece of documentation for your claim.

Lastly, consulting with a lawyer and preserving all evidence related to the accident, including medical reports and receipts, will help support your compensation claim.

How Is Fault Determined in California?

In California, the system in place for handling car accidents is fault-based or a “tort” system. This means that the person who is found to be at fault for causing the accident is responsible for compensating the damages incurred by the other party. This system is designed to ensure that those who suffer losses as a result of an accident are able to recover compensation for their damages, such as medical expenses, lost wages, and property damage.

The determination of fault in California involves a detailed analysis of the accident circumstances. Law enforcement officials and insurance companies play a significant role in this process. When an accident occurs, police officers typically arrive at the scene to gather evidence and make an initial determination of fault, which is documented in a police report. This report can be crucial in the fault determination process, but it’s not the final word. Insurance companies conduct their own investigations, reviewing police reports, statements from the drivers and witnesses, and any available physical evidence or photos from the accident scene.

California’s comparative negligence rule also affects how fault and compensation are determined. Under this rule, each party involved in an accident can be found partially at fault, with their compensation reduced by their percentage of fault. For example, if you are found to be 20% at fault for an accident and the other driver 80%, any compensation you would receive would be reduced by 20%. This approach aims to distribute the financial burden of the accident more equitably based on each party’s contribution to the incident.

In situations where you are not insured but the other driver is at fault, you can still file a claim against the at-fault driver’s insurance company for damages. Your lack of insurance does not negate your ability to pursue compensation under California law. However, driving without insurance is against the law in California, and you may face legal penalties independent of the accident claim. These penalties can include fines, the suspension of your driver’s license, and the impoundment of your vehicle.

Given these issues, seeking legal advice is often beneficial. An attorney can help with the process of fault determination, negotiate with insurance companies, and ensure that your rights are protected throughout the claims process. They can also assist in gathering and presenting evidence to support your claim, advocating on your behalf to achieve the best possible outcome.

What Are the Legal Considerations of Driving Without Insurance?

Driving without insurance is illegal in most states and can result in serious penalties, such as fines, license suspension, or even jail time. Driving without insurance in California is a violation of the Vehicle Code Section 16029. The penalties for driving without insurance in California depend on whether it is your first or subsequent offense and whether you were involved in an accident or not.

Here are some possible consequences:

- For a first offense, you may be fined between $100 and $200, plus penalty assessments that could increase the total amount to around $400. Your vehicle may also be impounded by the police officer.

- For a second offense within three years, you may be fined between $200 and $500, plus penalty assessments that could increase the total amount to over $1,000. Your vehicle may also be impounded by the police officer.

- If you are caught driving without insurance in an accident, your license will be suspended for one year for a first offense and up to four years for a subsequent offense. You will also need to file an SR-22 form with the DMV to reinstate your license, which may increase your insurance rates.

- California is also a “no pay, no play” state, which means that if you are uninsured and not at fault in an accident, you cannot sue the insured at-fault driver for non-economic damages, such as pain and suffering or inconvenience.

Driving without insurance in California is a serious offense that could cost you a lot of money and trouble. It is recommended that you always carry the minimum required liability insurance of 15/30/5 or an alternative form of financial responsibility to avoid these penalties and protect yourself in case of an accident.

However, if you are involved in a car accident and you are not at fault, your lack of insurance does not affect the liability of the other driver who caused the crash. You may still be entitled to compensation for your injuries and property damage from the at-fault driver or their insurance company. To protect your rights and interests, you should consult with a personal injury attorney who can advise you on the best course of action for your situation. A personal injury attorney can help you gather evidence, negotiate with the insurance adjuster, file a lawsuit if necessary, and represent you in court.

Depending on the circumstances of your case, you may be able to recover damages for your medical expenses, lost wages, pain and suffering, and other losses. A personal injury attorney can also help you deal with any claims or lawsuits brought against you by the other driver or their insurance company if they try to blame you for the accident or reduce your compensation.

FAQs on Uninsured Accidents When the Other Party is At Fault

For individuals involved in a car accident without insurance, where the other party is at fault, common questions may revolve around their rights to compensation, the process for filing a claim against the at-fault driver’s insurance, potential legal repercussions for driving uninsured, and how to manage medical expenses or vehicle repairs in the interim.

Let’s address some common questions about being involved in a car accident without insurance when the other driver is at fault:

Can I still receive compensation if I’m uninsured but not at fault?

Yes, being uninsured does not prevent you from pursuing compensation from the at-fault driver’s insurance for damages and injuries. However, driving without insurance is against the law and may result in penalties.

How do I file a claim if I don’t have insurance?

You would file a third-party claim directly with the at-fault driver’s insurance company. It’s advisable to consult with a personal injury attorney to navigate this process.

What happens if the at-fault driver also doesn’t have insurance?

If the at-fault driver is uninsured, you might be able to seek compensation through a lawsuit against the driver directly, though collecting on such a judgment can be challenging.

Will I face legal consequences for driving without insurance?

Yes, driving without insurance is illegal and can result in fines, suspension of your driver’s license, and impoundment of your vehicle, among other penalties.

What types of damages can I recover?

You can potentially recover costs for medical bills, car repairs, lost wages, and pain and suffering. The specifics would depend on the details of the accident and the extent of your injuries and damages.

These FAQs provide a basic understanding of your rights and obligations in situations where you’re involved in an accident without insurance, but the other party is at fault. For personalized advice, it’s best to consult with a legal professional.

What Is the Impact of California’s Insurance Laws?

California’s insurance laws have some implications for drivers who are in an accident and the other driver is at fault but they do not have insurance. Here are some key points to consider.

California is a fault-based state, which means that the driver who causes an accident is responsible for paying for the damages of the other parties involved. However, if the at-fault driver does not have insurance or enough insurance to cover the damages, the injured parties may have to seek compensation from their own insurance company or sue the at-fault driver personally.

California requires all drivers to have at least $15,000 in bodily injury liability insurance coverage for a single person injured in an accident they caused and $30,000 for all parties injured in the accident. These are the minimum amounts required by law, but they may not be enough to cover the medical bills and other losses of the injured parties, especially in cases of serious or catastrophic injuries.

California also requires insurers to offer uninsured motorist coverage (UMC) and underinsured motorist coverage (UIM) to drivers unless they waive it in writing. UMC and UIM are optional coverages that pay for the damages of the insured driver and their passengers if they are hit by a driver who has no insurance or insufficient insurance or who flees the scene in a hit-and-run. UMC and UIM coverages are typically equal to the liability coverage limits of the insured driver, but they can be lower if agreed upon in writing.

If a driver does not have insurance, they may face serious penalties, such as fines, license suspension, or even jail time. They may also be sued by the other driver or their insurance company for the damages they caused in the accident. If they do not have any assets or income to pay for the judgment, they may file for bankruptcy to avoid paying, but this may have negative consequences for their credit and financial future.

If a driver does not have insurance and they are not at fault for the accident, they may still recover for their economic damages, such as medical expenses, loss of earnings, and property damage, under Proposition 2134. However, they may not recover for their non-economic damages, such as pain and suffering, emotional distress, or loss of enjoyment of life, unless they fall under certain exceptions, such as being a victim of a drunk driver or a felon.

If a driver is in an accident and the other driver is at fault but does not have insurance, they should consult with a personal injury attorney who can help them pursue compensation for their damages. A personal injury attorney can help them gather evidence, negotiate with the insurance adjuster, file a lawsuit if necessary, and represent them in court. A personal injury attorney can also help them deal with any claims or lawsuits brought against them by the other driver or their insurance company if they try to blame them for the accident or reduce their compensation.

Pro Tip

How to Obtain an Accident Report in Orange County: Ensure you get a copy of the accident report from the California Highway Patrol (CHP), usually available within 10 days post-accident. This document is vital for your claim and is obtainable from any CHP office, not limited to the one near the accident scene.

Contact a California Car Accident Lawyer

While being uninsured presents challenges, the law provides pathways to seek justice and compensation when the other driver is at fault. Kevin Crockett and the Crockett Law Group are dedicated to guiding you through these situations, ensuring your rights are protected every step of the way. For more personalized advice, reach out to our office at (888) 965-3827 to discuss your specific situation.